is an inheritance taxable in michigan

Maryland is the only state to impose both. Inheritance Estate Law in Michigan.

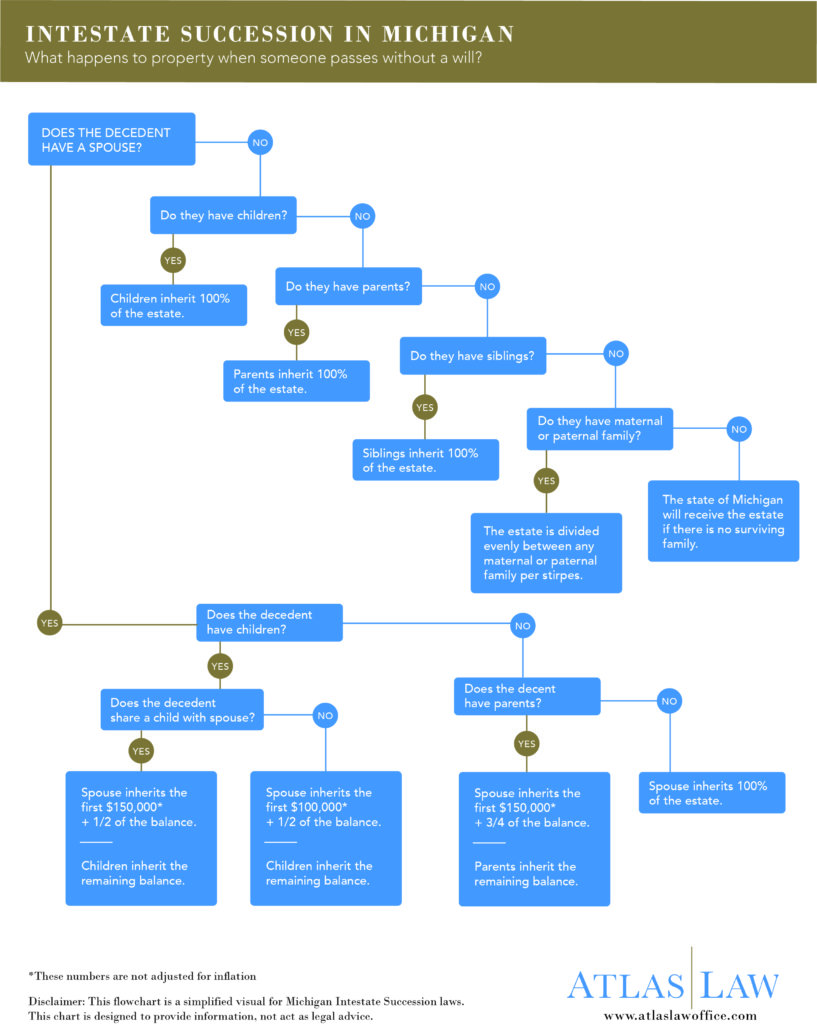

Michigan Rules Of Intestate Succession Atlas Law

I will be splitting it with my sisters.

. However the state in which you reside may have an inheritance tax if you live in a state other than MI. In Michigan different laws apply. If you indicate which state you.

Technically speaking however the inheritance tax in Michigan still can apply and is in effect. How much or if youll pay. Information You And Your Lawyer Could use For A Solid Trust.

However inheritance is only taxable in six states - Iowa Kentucky Maryland Nebraska NJ and Pennsylvania - and exemptions apply. Federal And Michigan Estate Tax Amounts On Inheritances States With No Estate Tax Or Inheritance Tax Plan Where You Die Historical Michigan Tax Policy Information. An inheritance tax is a levy.

Although Michigan does not impose a separate inheritance or estate tax on heirs you may have to pay state taxes on your annuity income. It only counts for people who receive. State inheritance tax rates range from 1 up to 16.

Technically speaking Michigan still retains an inheritance tax and an estate tax in its statutes but neither tax would apply to anyone who died today. Michigan does not have an inheritance tax. Mom recently passed and left an IRA with me listed as beneficiary.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate. There is only one thing you need to know about Michigan estate taxes on an inheritance. Estate laws set out rules and procedures for the disposition of property owned by someone who dies.

Regarding your question Is inheritance taxable income Generally no you usually dont include your inheritance in your taxable income. However if the inheritance is considered income in. Most probate transfers are nontaxable but please.

There is no federal inheritance tax but there is a federal estate tax. While the Michigan Inheritance Tax no longer exists you may be subject to the Michigan Inheritance Tax if you inherited an asset from an estate prior to 1993. Ad Request Free Inheritance Information For You Your Lawyer.

However it does not apply to any recent estate. Information You And Your Lawyer Could use For A Solid Trust. Ad Request Free Inheritance Information For You Your Lawyer.

According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of. Is there still an Inheritance Tax. As of December 31 2004 there is no death or estate tax for.

Mom had opted to have. Died on or before September 30 1993. Inheritance tax is levied by state law on an heirs right to receive property from an estate.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. The Michigan estate taxreturn picks up the maximum allowable credit amount fromthe US. Michigan Estate Tax.

Heres a breakdown of each states inheritance tax rate ranges. Only a handful of states still impose inheritance taxes. What is Michigan tax on an inherited IRA.

The State of Michigan does not. The short answer is yes. How Much Is the Inheritance Tax.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who.

Michigan Estate Tax Everything You Need To Know Smartasset

What Is Inheritance Tax Probate Advance

Examples Of Expansionary Monetary Policies Monetary Policy Financial Literacy Loan Money

What Is Inheritance Tax And Who Pays It Credit Karma

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Lower Tax Bill In Florida South Florida Real Estate Florida Real Estate Florida

Essential Qualities For Becoming An Inheritance Tax Specialist Tax Accountant Tax Preparation Inheritance Tax

Michigan Inheritance Tax Explained Rochester Law Center

Is Your Inheritance Considered Taxable Income H R Block

Pin On Knia Law Office Okmulgee Lawyers

What Taxes Are Associated With An Inheritance Rhoades Mckee

Michigan Estate Tax Everything You Need To Know Smartasset

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax Here S Who Pays And In Which States Bankrate